How Green are your Savings?

Many people are becoming more environmentally conscious and are looking for ways to reduce their carbon footprint. One area that is often overlooked is savings.

While it may not seem an obvious contributor to our climate crisis, the way you save your money can have a direct impact on the planet. We will explore the topic of green savings, ‘greenwashing’ and ethical finance; and provide information on how to assess the actual ‘greenness’ of your savings.

What are Green Savings?

Green savings refer to savings that are invested in environmentally friendly projects or institutions, from renewable energy and sustainable agriculture to clean transportation and a more sustainably built environment. By investing in such projects, you are directly supporting the growth of industries that are working towards a more sustainable society.

Aren’t My Savings Already Green?

In recent years, there has been increasing public concern about the ethical and environmental responsibility of banks and other financial institutions. In a 2021 survey, 60% of those polled said they would leave their bank if they found out it was linked to environmental or social harm. On the other hand, awareness around alternative sustainable and ethical finance remains low. Ecology’s own 2023 survey found that 45% of respondents believed they were already with a sustainable or ethical savings provider but were less certain on what they were doing in this space. And 54% said the reason for not being with a sustainable or ethical provider was that they didn’t know such providers existed.

Financial ‘Greenwashing’

Financial institutions are under increasing pressure to come clean about their environmental credentials and move away from fossil fuel production and deforestation. Despite commitments by the larger banks, including HSBC, Barclays and Natwest, to achieve net zero by 2050 it is still not clear how committed they are to a truly carbon neutral, sustainable future. A recent ShareAction report, investigating the green targets of Europe’s 20 largest banks, found “that their green targets and disclosures are not fit for purpose and could lead to misleading claims – aka greenwashing. These banks are trying to make themselves look better and greener than they actually are.”

So what do we mean by greenwashing?

‘Greenwashing’ refers to the practice of giving an unfounded or exaggerated impression of, or commitment to, sustainability in a company’s products, services, or business practices. Greenwashing presents a misleading image that a company is more environmentally responsible than it actually is. This can be done through misleading advertising, marketing, or public relations strategies that overstate the positive environmental aspects of a company while downplaying or concealing its negative impacts or by making claims with no evidence.

Greenwashing is particularly at play in the banking sector where we have stated commitments to a carbon neutral future while at the same time continuing to invest in fossil fuels and deforestation. In fact, since the adoption of the Paris Agreement in 2015 the world’s 60 biggest banks have invested $5.5 trillion in fossil fuels. And those 60 banks include such familiar UK High Street names as HSBC, Santander, Natwest, Lloyds and Europe’s biggest funder of fossil fuels, Barclays, a bank that claims on its website to be ‘dedicated to helping companies take action to address the environmental and sustainability challenges facing our planet’!

Detecting greenwashing, therefore, means looking beyond the green PR machine, the eco-friendly labels and symbols, and requires consumers to scrutinize environmental claims and assess whether a company’s actions align with its purported commitment to sustainability.

Assessing the Greenness of Your Savings

When it comes to assessing the greenness of your savings, there are several factors to consider, the most important of which is looking at where your money is invested. This can be more difficult than it first appears. It may be easier to understand with a building society, as typically money is used to lend to borrowers for a mortgage. With banks, however, your savings can also be invested with other companies and services, which might not be aligned to green values.

So how can we ensure our savings provider is genuinely aligned with sustainability and a commitment to net zero?

Fortunately, there are a number of organisations and watchdogs who work to expose greenwashing and promote transparency in environmental communications. We have already cited some of these organisations and they are a great way of assessing how green your current savings provider really is. They include:

Banking on Climate Chaos – download their comprehensive Fossil Fuel Finance Report 2023 which assess the world’s leading banks in terms of their financing – lending and underwriting – fossil fuel production ad expansion.

Bank.green provides a useful online tool to find out where your money goes and gives a climate score to financial institutions according to their contribution to funding the climate crisis.

Mother Tree have produced a useful bank league table based on how much £10,000 in a current account contributes in carbon emissions.

Forests & Finance evaluates the finance received by more than 300 companies directly engaged in the supply chains of beef, soy, palm oil, pulp and paper, rubber, and timber which have the potential to have a negative impact on natural tropical forests and the communities dependent on them.

The Good Shopping Guide offers a useful comparison table rating the ethical and environmental impact of the UK’s leading banks and building societies.

Ethical Consumer also ranks savings accounts and ISAs based on the financial providers’ sustainable and ethical practices.

Good With Money is another independent organisation that ranks the top ethical savings accounts based on social and environmental values

Green Certifications and Standards

Although there can also be bogus eco labels and symbols, there are some third-party certifications with more meaningful value. These can show that a product or institution meets certain environmental standards such as using renewable energy, reducing waste, or using sustainable materials.

Some examples of green certifications and standards include the Forest Stewardship Council, which certifies sustainably harvested wood products and the Rainforest Alliance whose aim is to protect forests, improve the livelihoods of farmers and communities and help them mitigate and adapt to the climate crisis.

Sustainability Ratings

As we have seen above, there are several organizations that rate the sustainability of financial institutions. Here at Ecology, for instance, we have been rated as a ‘Best Buy’ by Ethical Consumer magazine for our mortgages, ISAs and savings accounts in its product guide rankings. And Good With Money gave us a ‘Good Egg’ mark which is awarded only to companies that make a positive impact in the world.

Green Savings: Key Takeaways

- Green savings refer to savings that are invested in environmentally friendly projects or institutions.

- By saving sustainably you are actively contributing to make a positive impact on communities and the planet

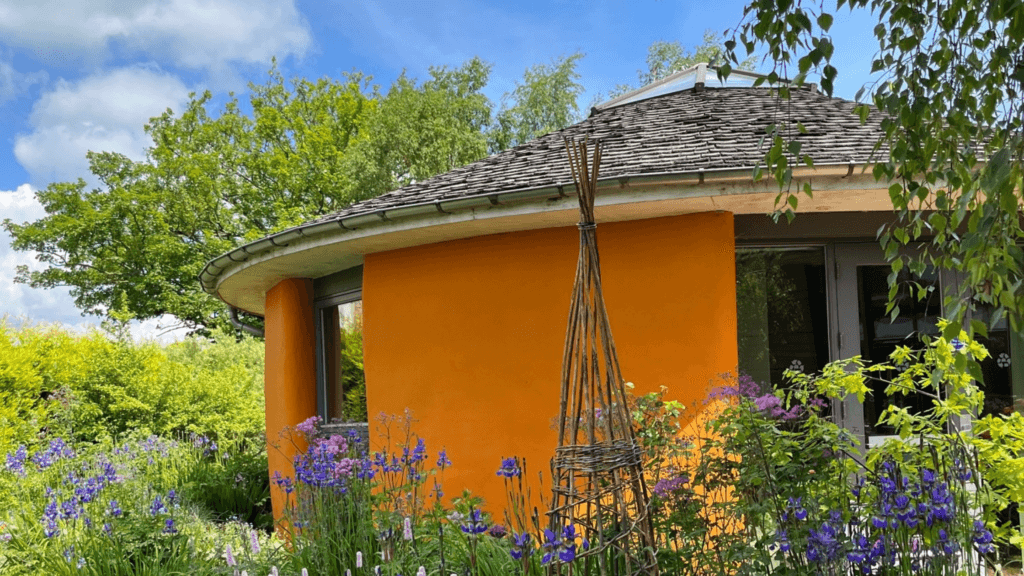

- To assess the greenness of your savings, look at where your money is invested. For instance, in Ecology’s case, you can see where our impact-led lending goes on our interactive map , or check out our customer projects.

- Remember, dig deep and don’t take what financial institutions say at face value; look for transparency and consider third-party certifications and ratings.

- Check the environmental impact of the companies and industries in which your money is invested. This can be difficult to determine, as many companies do not disclose their environmental impact or may have complex supply chains that make it hard to trace the origin of their products. Things to consider would include: a company’s carbon footprint (i.e. the amount of greenhouse gas emissions it produces); its water usage; waste production; and energy consumption.