How to cut through the greenwash?

Shoppers are wising up to the fact they wield a huge amount of influence over how businesses behave – they can take their custom and their money elsewhere if they believe a business doesn’t share their values.

But to make an informed and practical decision, they need clarity and transparency about what matters to them.

Retailers promote their recycling schemes for the products they sell, clothes manufacturers disclose employment practices for how and where their garments are made, and professional services firms report on efforts to improve diversity to better reflect their customer base.

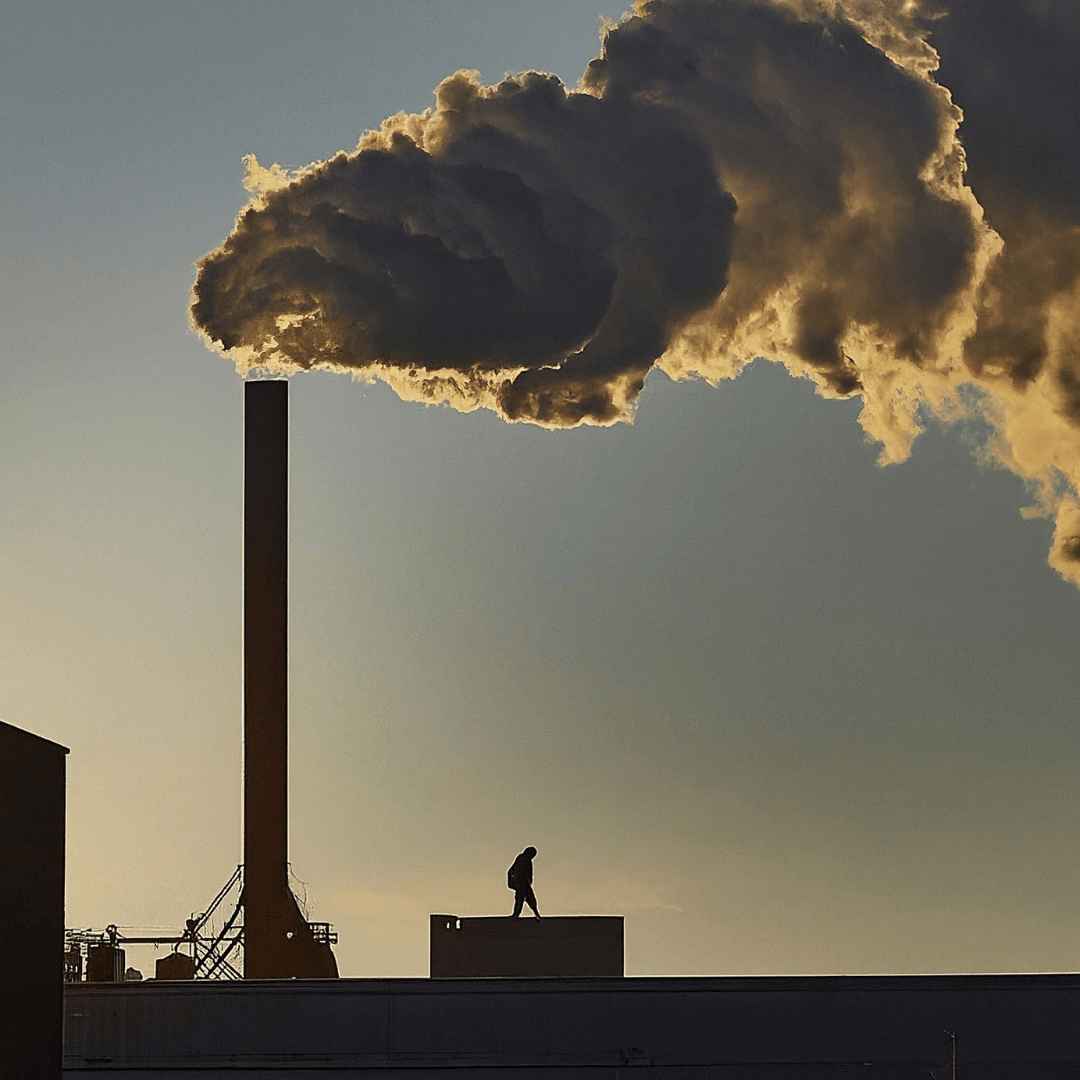

When it comes to “green” financial products, that term has been widely used and often a matter of interpretation. Does planting a tree in reward for opening a savings account make that product “green”? How much does the environment benefit from a mortgage rate incentivising a borrower to improve their home’s energy efficiency, when the mortgage lender also invests significant sums in the fossil fuel industry?

Better rules on green finance claims

People need help to cut through the greenwash so we’re really pleased that the FCA (Financial Conduct Authority) has updated its anti-greenwashing guidance for financial products.

Ecology commissioned independent research which found a clear preference for ethical choices when picking financial products. The majority (74%) of people wanted their money to have a positive environmental and social impact, although many of those surveyed were confused about how their own bank or building society used their money.

The new FCA guidance in force from 31 May means businesses it authorises, including Ecology, must ensure any sustainability claims are backed by robust, credible evidence – added oversight which is very welcome.

The FCA is not alone – in recent months other regulators, including the Advertising Standards Authority and the Competition and Markets Authority, have been visible in investigating and challenging high-profile greenwashing claims made by a range of businesses.

Power to change

We’re proud to have been an early and confident adopter of the Green Finance Institute’s Green Home Finance Principles, which are voluntary standards on finance for purchasing, retrofitting, or self-building a home with verifiable environmental benefits. We’d like the new guidance for financial services to be an acceleration point for greater clarity and simplicity around products and services badged as “green”.

Green finance remains a young – but growing – sector so it’s important that the rest of our industry responds and innovates to meet customer need as the market for green savings and mortgages evolves and grows. In time, we hope to stop talking about “green finance”. We need a world where “green finance” is the same as “finance”.

The sector can play a significant role in the path to net zero, supporting environmentally sustainable development and reducing the greenhouse gas emissions of the UK’s existing housing.

But savers, homeowners and investors must be able to have the confidence to be able to make the right decisions for the outcomes they need and their conscience.

Ecology puts this into practice

At Ecology you can be confident we’ve applied the Green Home Finance Principles. We reward our mortgage Members with interest rate discounts according to the energy-efficiency they achieve for their home. And by saving with us, you help to fund innovative green and sustainable homes and businesses across the UK.

We’re proud to support these inspiring projects and want you to be too, which is why we publish how many projects we’re currently supporting together, along with specific projects.