Financing Fossil Fuels: What You Can Do About It

Greenwashing

You may have seen the recent BBC Panorama documentary, Big Brands’ Green Claims Uncovered, which investigates the market for carbon credits based on ‘avoided deforestation’ projects. The programme exposes a number of issues concerning carbon offsetting: how it affects communities in countries such as Cambodia and Kenya; exposes human rights abuse; and carbon accounting methods which can mislead and exaggerate climate impact claims; in other words, leading to corporate ‘greenwashing’.

We have discussed greenwashing in a previous blog, but it’s worth reiterating that greenwashing is not simply a matter of a company being disingenuous about its green credentials; exaggerated climate claims lead us to believe that something is being done, whereas the truth is that nothing or not enough is being done and thus delays or retrogrades the effective climate action we need right now.

Fossil Fuel and Finance

If greenwashing is bad enough, actively financing fossil fuels is even worse. We have highlighted before the banks and financial institutions investing in the fossil fuel industry. But here’s a quick update. Did you know: in 2023 alone, the big five UK banks, HSBC, Barclays, Santander, NatWest and Lloyds funded fossil fuels production and exploration to the tune of $55bn! [source: https://www.bankingonclimatechaos.org]

A recent report produced by Make My Money Matter analysing pension providers and their relation to climate change concluded that ‘ for the most part providers are sorely lacking in those key areas that contribute the most to the climate emergency, such as fossil fuel expansion and deforestation.’ Despite claims to providing a climate solutions investment strategy, the report found that definitions were ‘fluid or lacking’, with no clear targets or adequate benchmarks for progress. As revealed in the BBC documentary, this lack of clear definition undermines positive climate action. In terms of fossil fuel funding and deforestation, the report found all the providers they investigated to be either ‘inadequate’ or ‘poor’.

Transparency and Ethical Finance

So What Can I Do About Climate Change?

There are a number of things an individual can do to tackle climate change. There are simple everyday ways of living more sustainably from putting LED lights in your home to replacing your gas boiler with an Air Sourced Heat Pump; from avoiding single-use plastics to leaving the car behind and using public transport or a bike. In these cases, every little helps. Bigger changes can be made in the way you heat and insulate your home (download our free Renovation Guide for more info) or even go the whole hog and build yourself an energy efficient eco-home! But there are other, and much simpler, things you can do.

Make Some Noise

Firstly, why not actually tell your bank to stop financing fossil fuel and deforestation? You can do this quite easily online at Make My Money Matter.

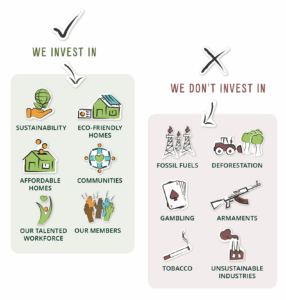

Switch Your Savings Account

Even more positively, you can make your hard-earned money actually work for the benefit of people and the planet, for instance, by switching your existing account an ethical savings provider like Ecology. We have a wide range of accounts including Regular Savings, Easy Access, 35-Day Notice, and our Ecology Cash ISA; every one of which makes a real and positive environmental impact. You can read about some of our success stories here.

Find out more about our range of ethical savings accounts.